With the widening gap between the richest and poorest across different measures of inequality, there is growing awareness that income is not the only factor that impacts living standards. This has led to increasing interest in the distribution of wealth. While wealth can take various forms, the most visible way households accrue and store substantial amounts of wealth is through property ownership.

Property wealth in Scotland has increased ten-fold over the last 50 years – driven primarily by rising house prices, but also by the increasing number of properties and transfer of public housing into the private sector. However, this wealth is not distributed equally. In its recent examination of the scale and distribution of housing wealth in Scotland over time, the Resolution Foundation highlighted the marked rise in housing wealth inequality over the last decade, which is now twice as high as income inequality.

Why?

The new report shows that the growing inequality in housing wealth is in large part due to the fact that while very few families in Scotland currently have no form of income, over one in three Scottish households hold no property wealth at all and those in the top income decile own around 30% of the country’s property wealth.

Additional property ownership has also increased in recent years, adding to the level of inequality. The biggest wealth gaps were found to be in Scotland’s largest cities – Aberdeen, Dundee, Edinburgh and Glasgow – where low rates of home ownership are coupled with ownership of multiple properties, concentrating housing wealth in fewer households’ hands.

In addition, the last decade has seen many people struggle to get a foot on the housing ladder and today’s young people hold less housing wealth than their predecessors. Location was also found to have an impact as house prices can differ greatly by local authority, although these variations have reduced in recent years.

As a result, levels of housing wealth inequality are now nearing the same levels as those in England and Wales, although rates of homeownership remain higher in Scotland than elsewhere in the UK.

With more people now having some form of income than ever before, it is perhaps reasonable to ask why housing wealth is so important.

The Foundation’s report highlights that owning property has value over and above general wealth effects in that it can also provide a secure home; a source of income; and greater financial security in later life. Indeed, the UK Collaborative Centre for Housing Evidence (CaCHE) and Policy Scotland’s evidence review, which complemented the Foundation’s analysis, also highlights why housing wealth matters, citing many economic, health and social impacts.

Why housing wealth matters

While it has been previously argued that housing wealth inequalities are of little significance in terms of macroeconomic impact and can therefore be disregarded, there is now a growing body of evidence suggesting that in fact these inequalities do matter. The evidence review notes that:

- housing assets are of growing importance encouraging household spending and were implicated in the global financial crisis;

- access to home ownership is increasingly reliant on parental property wealth with negative implications for social mobility;

- housing wealth is cumulative: e.g. buy-to-let has increased dramatically in Scotland over the last 20 years, often facilitated by the re-mortgaging of existing property by owners;

- rising house price and wealth effects reduces productivity growth; and

- different rates of house price change create inequalities across UK regions.

This is not only the case in Scotland and across the UK; across Europe housing wealth inequality has been shown to exacerbate socio-economic differences by segregating households based on income levels.

In relation to health and wellbeing, housing wealth can be a double-edged sword. A rise in house prices can lead to increased physical health of owners but decreased physical and mental health of renters.

Of course, historically, housing wealth has been seen to contribute to reduced wealth inequalities due to increased home ownership, however, there is now also an emerging concern that high house prices and rents may impair labour supply and productivity.

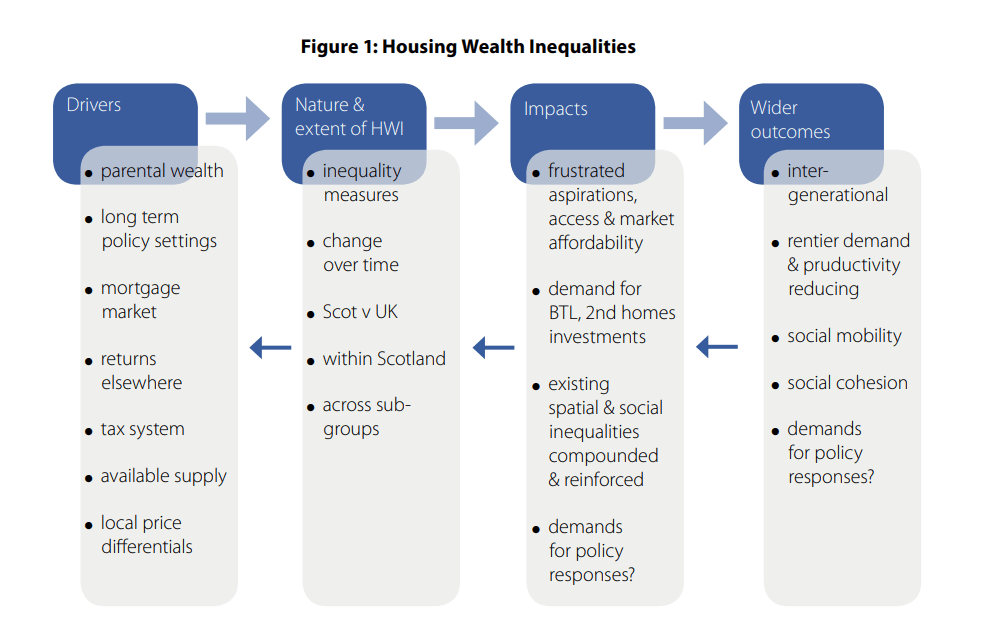

Main elements of wealth inequality processes within the housing system (CaCHE, 2019)

It is clear that income is not the only important factor in inequalities. This is illustrated by recent figures on child poverty and in-work poverty, which show that despite recent record levels of employment, two thirds of children living in poverty come from working households and more than half the people living in relative poverty in 2017/18 (53%) lived in households where at least one adult was in paid employment.

The Resolution Foundation notes that while the scale and distribution of housing wealth has changed dramatically over the past 50 years, wealth taxation has not.

Indeed, it has been recently argued that policy is widening the housing wealth divide and that the local supply of housing needs to be realigned with local housing demand if this is to be rectified.

Way forward

The research suggests that a number of actions could be taken to address the growing housing wealth inequalities in Scotland:

- Firstly, support for sustainable home ownership, especially for those on lower incomes or in the younger age bracket is highlighted as one obvious response, although it notes that policies such as Help to Buy risk stimulating demand to the point that house prices are driven up. As a result, it is suggested that policy action to lessen the demand for holding additional properties would be a more sensible strategy.

- Second, it is argued that there is a strong case for substantial reform in the area of the property taxation to address the current mismatch between the value of housing wealth and taxation.

- Third, it is suggested that the Scottish Government could give consideration as to how the benefits of holding housing wealth can be provided to those who are unlikely to ever be able to support home ownership, with more efficient taxing of housing wealth. In addition, the government could also build on their recent reforms which have provided tenants with greater security of tenure and more predictable rent increases, and look to provide more support to low-income families via further supplements to benefits.

With the current system of council tax described as “highly regressive”, “inequitable” and “inefficient”, the research calls for much needed reform.

Both reports acknowledge that radical change is a political challenge but while the Resolution Foundation’s report states the case for action is clear, the evidence review advises caution, suggesting that a more equal housing system is a long-term aspiration rather than something practical and realisable in the short to medium term.

If you enjoyed reading this, you may also be interested in some of our previous posts on housing topics.

Follow us on Twitter to keep up to date with our latest blog posts and find out what topics are catching the eyes of our Research Officers.

Share

Related Posts

Supporting residents on the decarbonisation journey: leveraging data for effective retrofit projects

As the drive towards decarbonisation intensifies, the social housing sector’s ability to collect, store and manage vast amounts of data becomes increasingly critical. With a shared goal of creating warmer, carbon-free homes, housing associations’ strategic use of data is essential ....

The recent spikes in energy costs have thrown into sharp focus the challenge of heating our homes. Domestic heating is important, not just for our comfort and wellbeing, but to reduce humidity and prevent condensation. But because traditional heating systems ....

By Sarah Perry At the end of June, GrantFinder attended The Chartered Institute of Housing’s annual conference, Europe’s largest housing festival. The event took centre stage at Manchester Central, bringing together industry experts, policymakers, and housing practitioners from across the ....

By Ian Babelon In the first part of two blog posts, published on 22 May, Ian Babelon provided examples of good practice in retrofitting social housing. The second part of this blog post looks at estate-wide and area-wide social housing ....